By Dr. Magesh Kasthuri, Distinguished Member of Technical Staff, Wipro Limited and Jayashree Arunkumar, Enterprise Architect, Wipro Limited

In the rapidly evolving world of Banking, Financial Services, and Insurance (BFSI), the adoption of advanced technologies is imperative. Among these, Agentic AI solutions stand out as transformative tools that can drive efficiency, accuracy, and innovation across various business use cases. This article delves into the role of Agentic AI in rationalizing operations within the BFSI sector, exploring its application in front office, mid office, and back office operations. We are leveraging Microsoft’s AutoGen framework for Core Banking use cases in this article.

The core IT operations of BFSI industry is categorized into Front office operations which are end-user facing applications, Mid office operations which are internal customer agent solutions and Back office operations which are internal data management solutions. Agentic AI can be applied across various use cases in these categories of applications which are discussed in this article.

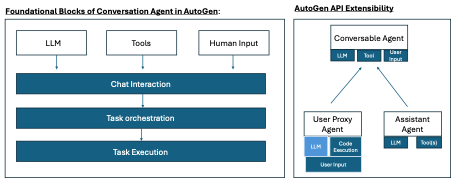

AutoGen Foundational Architecture

In the dynamic landscape of the Banking, Financial Services, and Insurance (BFSI) sector, the integration of advanced technology solutions is paramount. Microsoft Autogen has emerged as a pivotal tool in this domain, offering a blend of efficiency, security, and innovation that aligns perfectly with the needs of agentic solutions. This essay explores the reasons why Microsoft Autogen is particularly well-suited for this industry, highlighting its capabilities and benefits.

One of the foremost advantages of Microsoft Autogen is its ability to streamline operations within the BFSI sector. By automating repetitive and time-consuming tasks, it allows financial institutions to focus on more strategic activities. For instance, the automation of data entry, report generation, and compliance checks not only reduces the risk of human error but also accelerates processing times. This leads to increased productivity and cost savings, enabling institutions to allocate resources more effectively.=

AutoGen supports Polyglot workflow orchestration. Each agent can be configured to the best suited LLM . For example, below architecture uses Conversable Agent, User Proxy Agent and Assistant Agent. Conversable Agent needs LLM configuration, UserProxy Agent prime function is to take user inputs – optionally can take LLM as per the needs and Assistant Agent needs LLM configuration.

Figure: Autogen based Foundational Reference Architecture

Front Office Operations

Core Banking Applications

In the realm of core banking applications, Agentic AI can enhance a range of services, from transaction processing to fraud detection. By integrating AI-driven predictive analytics, banks can anticipate customer needs and offer personalized financial products and services. For instance, AI algorithms can analyze transaction histories and spending patterns to recommend suitable investment options or credit products.

Leveraging Microsoft Autogen, banks can develop sophisticated AI models to automate transaction monitoring and detect anomalies in real-time. By integrating with core banking systems, Autogen can provide enhanced security features, reducing the incidence of fraud and unauthorized transactions. Additionally, Autogen’s predictive analytics capabilities can offer personalized recommendations to customers, boosting engagement and satisfaction.

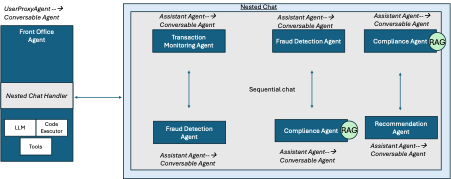

Multi Agent Conversation Pattern Reference Implementation for Front Office Agent in Core Banking

Figure: Reference architecture of Core banking solution with Autogen Agentic AI

RAG in Compliance: The Compliance Agent leverages a retrieval-augmented generation pipeline to fetch relevant policy documents before finalizing its decision

| Step | Trigger Agent | Recipient Agent | Purpose |

| 1 | Core Banking System (CBS)/User Request | Front Office Agent | A new transaction or user request (e.g., “Transfer $20,000”) arrives. The User Proxy Agent is the entry point for the workflow. |

| 2 | Front Office Agent | Transaction Monitoring Agent | The User Proxy Agent initiates a nested chat with Transaction Monitoring to evaluate if the transaction is normal or suspicious. |

| 3 | Transaction Monitoring Agent | Fraud Detection Agent (if suspicious) | If flagged as suspicious, Transaction Monitoring escalates to Fraud Detection for deeper ML checks against known fraud patterns. |

| 4 | Fraud Detection Agent | Compliance Agent (with RAG) | If Fraud Detection finds potential issues or remains uncertain, it passes the case to the Compliance Agent to run regulatory checks using RAG. |

| 5 | Compliance Agent (RAG) | Recommendation Agent (if approved) | Compliance retrieves relevant policy docs (RAG) to confirm or deny the transaction. If approved, it notifies the Recommendation Agent. |

| 6 | Recommendation Agent | Front Office Agent | The Recommendation Agent uses predictive analytics to propose personalized products. It returns these suggestions to the User Proxy Agent. |

| 7 | Front Office Agent | Core Banking System / End User | The User Proxy Agent relays the final outcome (approved/denied) and any product recommendations back to the core system or the user. |

In front-office operations, AutoGen merges the agent’s role with the user’s real-time questions to form a targeted prompt. The LLM then generates a precise, context-aware response, empowering agents to resolve customer issues swiftly. By streamlining these interactions, banks elevate service quality while reducing overhead for live support teams.

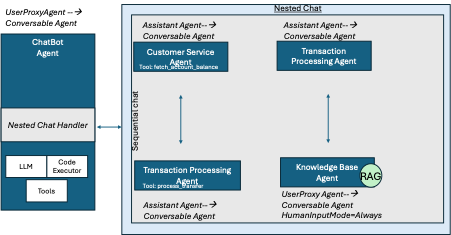

Customer Facing Applications

Agentic AI solutions are pivotal in customer-facing applications, such as chatbots and virtual assistants. These AI-powered tools provide 24/7 support, handling inquiries, processing transactions, and resolving issues with remarkable efficiency. Imagine a scenario where a customer queries their account balance or recent transactions; an AI-driven chatbot can instantly provide accurate information, enhancing customer satisfaction and reducing wait times.

By integrating Microsoft Autogen with customer-facing applications, banks can build advanced chatbots capable of understanding and responding to complex queries. Autogen’s natural language processing (NLP) capabilities ensure that interactions are smooth and human-like, improving the overall customer experience. Furthermore, the system can be trained to recognize patterns in customer interactions, enabling it to anticipate needs and provide proactive support.

Figure: Reference architecture for Agentic AI for customer facing applications

| Step | Trigger | Recipient | Purpose |

| 1 | Customer (via chat UI) | ChatBot Agent | Sends a question or request (e.g., “What’s my account balance?”). |

| 2 | Chat Bot Agent | Customer Service Agent | Initiates nested chat to retrieve the needed information (e.g., account data). |

| 3 | Customer Service Agent | Transaction Processing Agent (if needed) | If the user requests a transfer, escalates to the Transaction Processing Agent for handling. |

| 4 | Customer/Transaction Agent | Knowledge Base Agent (optional) | For more complex or unusual inquiries, calls a knowledge base (RAG) to fetch FAQs or policy details. |

| 5 | Any Specialized Agent | Chat Bot Agent | Returns the final response or outcome (e.g., “Your balance is $2,500”). |

| 6 | ChatBot Agent | Customer (front-end UI) | Provides the final answer or action confirmation (e.g., “Transfer complete”). |

Mid Office Operations

Intranet Applications

Intranet applications, such as customer agent services, benefit significantly from Agentic AI. By leveraging AI, organizations can streamline workflows and optimize resource allocation. AI algorithms can predict peak call times, ensuring that sufficient customer service representatives are available, thereby improving response times and service quality.

Microsoft Autogen can be employed to enhance intranet applications by offering real-time analytics and insights. For example, it can analyze call center data to predict busy periods and optimize staff scheduling accordingly. Additionally, Autogen can provide agents with real-time information and suggestions during customer interactions, allowing them to resolve issues more effectively and efficiently.

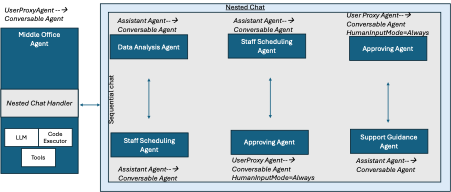

Figure: Reference architecture for Agentic AI in Mid-office operations=

process_call_center_data – is registered as a tool for the Data Analysis Agent. This allows the Data Analysis Agent to invoke that function during a nested chat conversation. By registering process_call_center_data as a tool for the Data Analysis Agent, you let the LLM agent decide when to invoke it for data analysis tasks

| Step | Trigger Agent | Recipient Agent | Purpose |

| 1 | Call Center Data Pipeline (system) | MiddleOffice Agent | New call center metrics (e.g., daily call logs) are fed into the User Proxy, initiating the workflow. |

| 2 | Middle Office Agent | Data Analysis Agent | Passes the incoming data (call volumes, AHT, etc.) for forecasting busy periods and future workloads. |

| 3 | Data Analysis Agent | Staff Scheduling Agent | Once forecasts are generated (peak hours, expected volumes), the results go to Staff Scheduling. |

| 4 | Staff Scheduling Agent | Aprroving Agent | Creates an optimized staffing plan; sends it back for human-in-the-loop approval or adjustments. |

| 5 | Approving Agent (approved) | Support Guidance Agent | If the schedule is confirmed, also update the real-time guidance engine for on-call suggestions. |

| 6 | Support Guidance Agent | Middle Office Agent | Concludes by returning final instructions (e.g., “Guidance set for next peak hours”) to the User Proxy. |

Customer Agent Services

AI also assists customer agents by providing real-time insights and suggestions during interactions. For example, when an agent is assisting a customer with a mortgage application, AI can instantly access and analyze relevant data, offering personalized recommendations and highlighting potential issues, thereby enabling agents to provide more informed and efficient service.

Integrating Microsoft Autogen with customer agent services can lead to significant improvements in service quality. Autogen’s data analysis capabilities enable it to provide agents with up-to-date information on customer profiles and transaction histories. This allows agents to offer personalized advice and solutions, enhancing the customer experience and building stronger relationships.

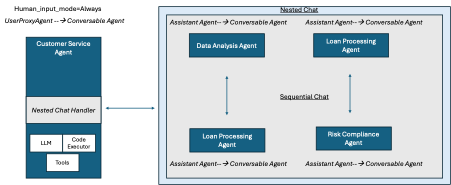

Figure: Reference architecture for Agentic AI for Customer agent services

Context setting & segregation within the multi agent interaction is achieved through targeted system prompts configured for each agent. AutoGen simplifies the orchestration and enables deeper task executions happen for each agent to speed up the personalized recommendation and loan eligibility processes.

Selected model inclusion as per the fitment to each Agent , right from the pre-trained to fine-tuned models uplifts the tasks execution in an efficient manner in the complex workflow illustrated above.

Each time a message is received, AutoGen creates and curates the prompt for the underlying LLMs.

| Step | Trigger Agent | Recipient Agent(s) | Purpose |

| 1. Retrieve Customer Insights | CustomerServiceAgent | DataAnalysisAgent | Fetch customer financial data from Banking APIs. |

| 2. Recommend Financial Products | DataAnalysisAgent | Customer Service Agent | Provides tailored financial recommendations. |

| 3. Loan Request Handling | Customer Service Agent | LoanProcessingAgent | Customer accepts a loan recommendation, triggering the loan application. |

| 4. Loan Processing Initiation | LoanProcessingAgent | DataAnalysisAgent | Requests additional financial history if needed. |

| 5. Risk Evaluation | LoanProcessingAgent | RiskComplianceAgent | Evaluates credit score and transaction risks & compliance. |

| 6. Final Decision | RiskComplianceAgent | Customer Service Agent | Delivers loan approval or rejection to the customer. |

Back Office Operations

Batch Processing

In back office operations, particularly batch processing, Agentic AI solutions can automate and optimize routine tasks, enhancing accuracy and reducing processing times. AI-driven automation can handle vast amounts of data, ensuring that end-of-day processing is completed swiftly and without errors. For instance, financial institutions can automate reconciliation processes, identifying discrepancies and resolving them autonomously.

Microsoft Autogen can streamline batch processing tasks by automating data entry and validation processes. By integrating with existing systems, Autogen can handle large volumes of transactions, ensuring that all entries are accurate and up-to-date. Additionally, its anomaly detection capabilities can identify and flag discrepancies for further review, minimizing errors and speeding up processing times.

End of Day Processing

End of day processing in banks and financial institutions involves numerous repetitive tasks, such as ledger updates and report generation. Agentic AI can streamline these processes by automating data entry and validation, ensuring that all transactions are accurately recorded and reports are generated promptly. This not only increases operational efficiency but also minimizes the risk of human error.

Using Microsoft Autogen for end-of-day processing can greatly enhance efficiency and accuracy in back office operations. By employing Autogen’s machine learning algorithms, financial institutions can automate the generation of financial reports and the updating of ledgers. This reduces the workload for back office staff and ensures that all data is processed accurately and on time.

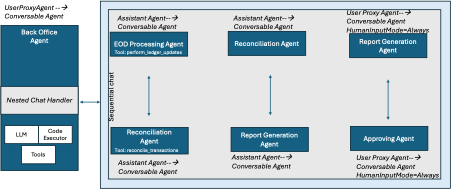

Figure – Reference architecture for Agentic AI implementation in Backoffice implementation

perform_ledger_updates – is registered as a tool for the EOD Processing Agent. Reconcile_transactions – registered as a tool for the Reconciliation Agent.

| Step | Trigger | Recipient | Purpose |

| 1 | Core Banking System | Backoffice Agent | Triggers EOD processing (e.g., “End of Day event started”). |

| 2 | Backoffice Agent | EOD Processing Agent | Initiates nested chat for batch tasks (ledger updates, data validation). |

| 3 | EOD Processing Agent | Reconciliation Agent | Once ledger updates are done, checks for transaction discrepancies. |

| 4 | Reconciliation Agent | Approving Agent (if anomalies) or Report Generation Agent (if all clear) | Escalates to user if major anomalies exist, otherwise proceeds to generate final EOD reports. |

| 5 | Report Generation Agent | Backoffice Agent | Produces EOD reports (regulatory, internal) and sends them for final review or sign-off. |

| 6 | Backoffice Agent | Core Banking System (updated) | Confirms completion of EOD, logs final status, or addresses any exception |

In back-office operations, AutoGen constructs a prompt that merges the agent’s system role with real-time data. he agent’s LLM analyzes the combined context and decides whether to invoke the perform_ledger_updates tool (in a full AutoGen setup) or simply explain the outcome.

The LLM then analyzes this context to identify discrepancies or confirm reconciliations. By automating such routine checks, organizations achieve faster processing, fewer errors, and streamlined end-of-day workflows.

Step 1: Core Banking System → Backoffice Agent[User Proxy Agent]

- What Happens: The Core Banking System emits an EOD trigger (“End of Day event started”).

- LLM Usage:

- Minimal or None at this stage.

- The system event is typically a non-LLM signal. The User Proxy Agent is just receiving a raw notification (e.g., a JSON payload or an API call).

- Under the Hood:

- The LLM is not invoked here. The agent (User Proxy) is simply listening for an event from the bank’s core system.

- Once the event arrives, the User Proxy will create a prompt for the next step (“We have an EOD event. Let’s start the process.”).

Step 2: Backoffice Agent[User Proxy Agent ]→ EOD Processing Agent

- What Happens: The User Proxy Agent initiates a nested chat with the EOD Processing Agent to begin ledger updates and batch tasks.

- LLM Usage:

- The User Proxy Agent is an LLM-based agent that can interpret or reframe the system event into a user message or “system message” for the EOD Processing Agent.

- Prompt Construction:

- The User Proxy has its own system message (e.g., “You are the user-facing portal for EOD tasks”).

- It composes a user message: “Perform EOD tasks with data: {transaction_data}.”

- Under the Hood:

-

-

- Tokenization: The prompt (system + user message) is tokenized.

- LLM Reasoning: The User Proxy LLM might decide to do minimal processing (like a pass-through), or add context if you coded it that way.

- generate_reply: The conversation is handed off to the EOD Processing Agent.

-

Step 3: EOD Processing Agent → Reconciliation Agent

- What Happens:

- The EOD Processing Agent updates ledgers (via a tool if needed), then sends the results to the Reconciliation Agent for discrepancy checks.

- LLM Usage:

-

- System Message: “You handle ledger updates… you can call ‘perform_ledger_updates’.”

- User (or agent) Message: From the previous step, e.g., “Perform EOD tasks with data: {…}.”

- LLM Decides:

- The EOD Processing Agent’s LLM sees it needs to do ledger updates.

- If it calls perform_ledger_updates, AutoGen intercepts that function call. The tool is executed, and the result is fed back into the conversation.

- Prompt for Reconciliation:

- After ledger updates, the agent forms a new message: “Ledger updates complete. Proceed to reconciliation?” and initiates chat with the Reconciliation Agent.

- Under the Hood:

- The EOD Processing Agent’s LLM merges system instructions, conversation history, and tool usage.

- If the LLM output is a function call, AutoGen runs that function, captures the output, and re-injects it as a new message for the LLM to see (closing the loop).

Step 4: Reconciliation Agent → Backoffice Agent/User Proxy Agent (if anomalies) or Report Generation Agent (if clear)

- What Happens:

- The Reconciliation Agent uses a reconcile_transactions tool to detect any discrepancies.

- If anomalies are found, it escalates to the User Proxy. If not, it proceeds to Report Generation.

- LLM Usage:

-

- System Message: “You compare transaction logs for discrepancies. You can call ‘reconcile_transactions’.”

- Agent/Tool Interaction:

- The LLM might produce a function call: reconcile_transactions(logs=”…”).

- AutoGen runs the function, gets “Discrepancy found!” or “All clear.”

- Branching:

- If the LLM sees “Discrepancy found!”, it decides to create a message for the User Proxy.

- Otherwise, it forms a message for the Report Generation Agent.

- Under the Hood:

- The Reconciliation Agent LLM effectively decides which recipient to contact next based on the tool’s output.

- The conversation is updated with the function result (“Discrepancy found!”) as a new message.

- The LLM interprets that result to either escalate or proceed.

Step 5: Report Generation Agent → Backoffice Agent[User Proxy Agent]

- What Happens:

- The Report Generation Agent compiles final EOD reports.

- Returns the results to the Backoffice Agent[User Proxy] for final sign-off or storage.

- LLM Usage:

-

- System Message: “You produce end-of-day reports.”

- Conversation: The agent receives a message: “Reconciliation complete. Generate final EOD report.”

- LLM might not need a tool here (unless you define a generate_report tool). It can simply produce a text summary: “Final EOD report: All transactions balanced.”

- Under the Hood:

- The Report Generation Agent merges the system instructions with the incoming message.

- The LLM constructs a textual “report.” If you have a tool for formatting or PDF generation, it might call that function.

- It then sends the final text or data structure back to the Backoffice Agent [User Proxy.]

Step 6 : Backoffice Agent [User Proxy Agent ] → Core Banking System (updated)

- What Happens:

- The Backoffice Agent[User Proxy Agent] receives the final EOD report or “all clear.”

- It notifies the Core Banking System or logs the final status.

- If anomalies exist, it might prompt a human to confirm or override.

- LLM Usage:

- Typically minimal at this final step. The Backoffice/User Proxy might do some final text summarization or forward the message “EOD complete” to the bank’s internal systems.

- If you have human involvement, the LLM could ask: “Manager, do you confirm final EOD closure?” Then it waits for manual input.

- Under the Hood:

- The conversation effectively closes. The Backoffice/User Proxy can store or log the conversation in a database for audit.

- No further tool calls are usually needed unless you want to do extra tasks (like archiving logs).

Business Use Cases and Solution Approaches

Case Study: Fraud Detection and Prevention

A leading bank implemented an Agentic AI solution for fraud detection and prevention in its core banking system. By analyzing transaction patterns in real-time, the AI system could identify unusual activities indicative of fraud. This proactive approach enabled the bank to prevent fraudulent transactions before they occurred, safeguarding customer assets and enhancing trust.

By leveraging Microsoft Autogen’s advanced data analysis capabilities, the bank was able to enhance its fraud detection mechanisms. Autogen’s real-time transaction monitoring and anomaly detection features allowed the bank to identify and prevent fraudulent activities more effectively, providing a higher level of security for its customers.

Case Study: Personalized Banking Services

Another financial institution leveraged Agentic AI to offer personalized banking services. By analyzing customer data, the AI system identified individual preferences and financial goals, allowing the bank to tailor its product offerings. This resulted in increased customer engagement and loyalty, as clients received services that aligned with their specific needs and aspirations.

Using Microsoft Autogen, the financial institution developed a sophisticated AI model to analyze customer data and provide personalized service recommendations. Autogen’s predictive analytics capabilities enabled the bank to offer tailored financial products and services, enhancing customer satisfaction and loyalty.

Case Study: Optimizing Customer Service

An insurance company utilized Agentic AI to optimize its customer service operations. AI-powered virtual assistants handled common inquiries, while more complex issues were escalated to human agents. This hybrid approach reduced response times, improved customer satisfaction, and allowed human agents to focus on higher-value tasks, enhancing overall operational efficiency.

By integrating Microsoft Autogen with its customer service operations, the insurance company was able to significantly enhance its service quality. Autogen’s virtual assistants handled routine inquiries, while its advanced data analysis capabilities provided human agents with the information they needed to resolve complex issues. This hybrid approach improved response times and customer satisfaction, allowing the company to provide a higher level of service.

Implementing Agentic AI Solutions

To implement Agentic AI solutions in the BFSI sector, organizations must follow a structured approach. This involves:

- Assessment: Identifying areas where AI can add value, such as customer service, fraud detection, or process automation.

- Integration: Integrating AI systems with existing infrastructure, ensuring seamless data flow and compatibility.

- Training: Training AI models with historical and real-time data to enhance accuracy and performance.

- Deployment: Deploying AI solutions in a phased manner, starting with pilot projects to test efficacy and make necessary adjustments.

- Monitoring: Continuously monitoring AI performance and making iterative improvements to optimize outcomes.

Conclusion

Agentic AI solutions hold immense potential to revolutionize the BFSI sector by enhancing efficiency, accuracy, and customer satisfaction. From automating routine tasks in back office operations to providing personalized services in front office applications, AI-driven technologies are set to redefine the future of banking, financial services, and insurance. By embracing these innovations, organizations can stay ahead of the curve, delivering superior value to their customers and stakeholders.

Microsoft Autogen exemplifies the convergence of technology and finance, offering a comprehensive solution that addresses the unique needs of the BFSI industry. Its ability to streamline operations, enhance data management, ensure security and compliance, and provide scalability and flexibility makes it an ideal choice for agentic solutions. Moreover, its commitment to innovation and future-readiness positions it as a valuable asset in navigating the complexities of the financial landscape. As the BFSI sector continues to evolve, Microsoft Autogen stands ready to support institutions in achieving their strategic goals and delivering exceptional value to their clients.

References

- https://www.weforum.org/stories/2024/12/agentic-ai-financial-services-autonomy-efficiency-and-inclusion/

- https://www.akira.ai/blog/banking-operations-with-ai-agents

- https://www.citigroup.com/global/insights/agentic-ai

- https://www.forbes.com/councils/forbesbusinessdevelopmentcouncil/2024/11/15/how-agentic-ai-is-enabling-the-next-frontier-of-innovation-for-banks/

- https://www.thebanker.com/content/886b880f-fc01-458d-81a5-4ad4c27815da